The Swiss crowdfunding market has experimented a promising 36% growth in 2014, according to a new report. Experts expect the industry to grow further as peer-to-peer lending, reward-based crowdfunding and crowddonating are becoming widely popular.

Crowdfunding is gaining popularity in Switzerland, as entrepreneurs are increasingly turning to this alternative way of raising capital to reach thousands, if not millions, of potential investors over the Internet.

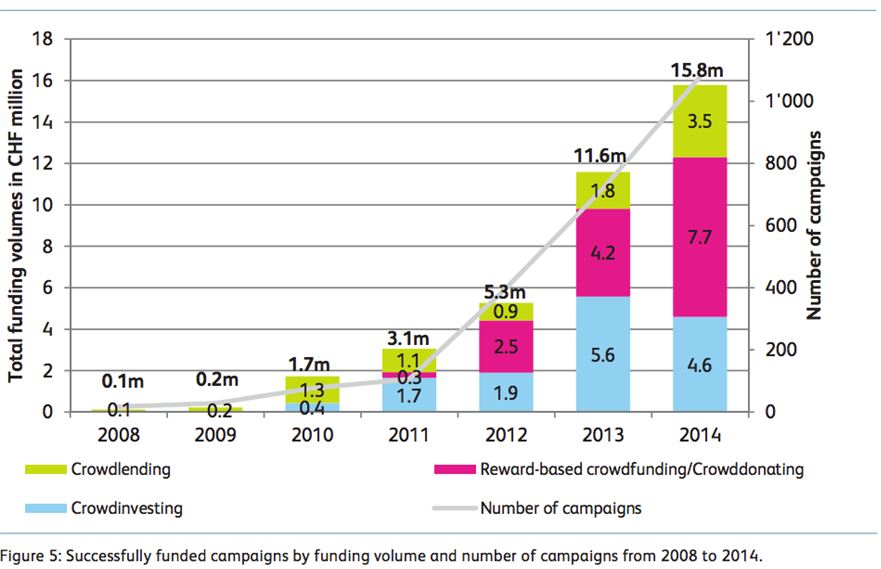

According to a recent report from the Institute of Financial Services Zug IFZ of the Lucerne School of Business, CHF 15.8 million was raised for 1078 campaigns in 2014: a 36% increase compared to 2013 with CHF 11.6 million.

Reward-based crowdfunding, a collaborative goal-based process that typically rewards funders with products, and crowddonating, stands as the biggest segment representing 49% of the overall Swiss crowdfunding market.

Crowdlending, also known as peer-to-peer lending, experienced the highest growth rate with 95%. Reward-based crowdfunding and crowddonating, has experienced the second highest growth rate with 82%.

Forecast

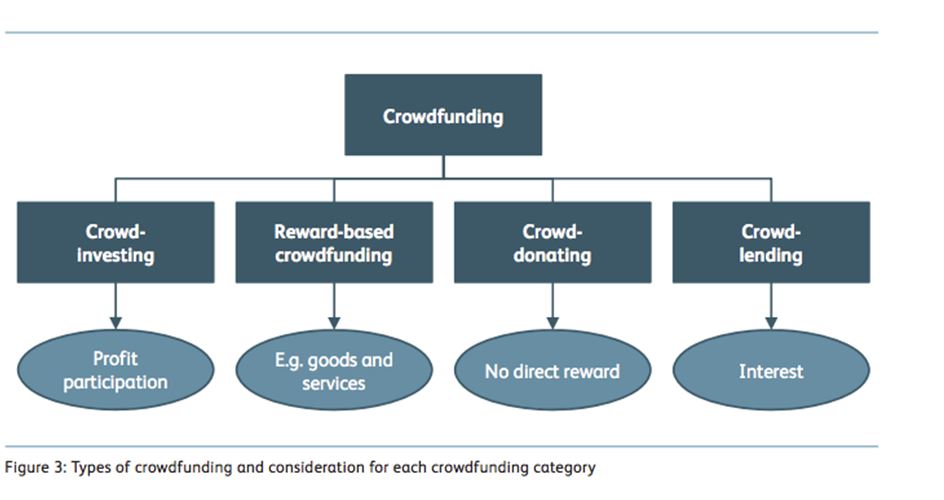

The report addresses the four segments constituting the overall crowdfunding market. These segments include crowdinvesting, reward-based crowdfunding, crowddonating, and crowdlending.

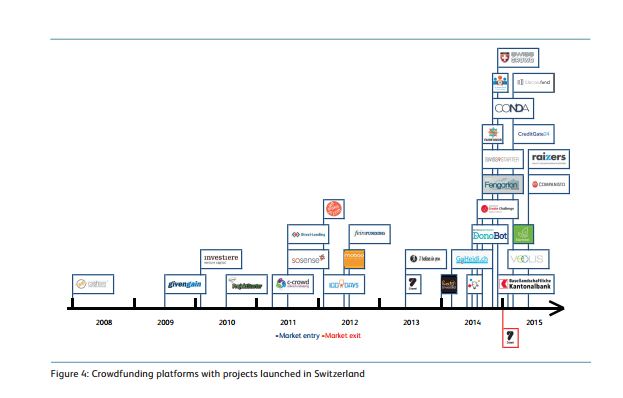

Since the launch of the first Swiss crowdfunding platform in 2008, the market has grown steadily. As of today, there are 30 platforms available in Switzerland with a physical office.

Popular reward-based crowdfunding platforms include Wemakeit, 100-days, „I believe in you,“ as well as miteinander erfolgreich, a platform launched in late-2014, operated by Basellandschaftliche Kantonalbank, the Cantonal Bank of the Canton of Basel-Land.

But the number of Swiss players will increase sharply in the coming year, as there is „great market potential,“ according to the report.

Prof. Dr. Andreas Dietrich, Head of the Financial Services Management Competence Centre and an author of the report, stated:

The total crowdfunding market will continue to grow significantly both in terms of volume and in terms of the number of successfully funded campaigns. We expect a volume for next year between CHF 25 and 30 million.

Crowdlending and reward-based crowdfunding are the two most promising segments. Crowddonating on the other hand, should become a greater focus of non-profit organizations.

Regulation

We expect that the first large, well-known organizations will try out crowdfunding via the Internet this year, or at the latest by next year. We see great potential in this market.

However, regulation will have a significant impact on market growth. The report suggests that inappropriate regulation could slow down market maturation.

If regulation in Switzerland is devised without taking into the account the regulatory environment abroad, not only could growth in the Swiss crowdfunding market decrease, but also there could be an increase in outsourcing of Swiss projects to foreign platforms.

It continued:

As a result, appropriate regulation is desirable for this market still in its infancy to be able to prosper. However, this seems fairly unrealistic this year given the current marginal significance of the crowdfunding market.

European market

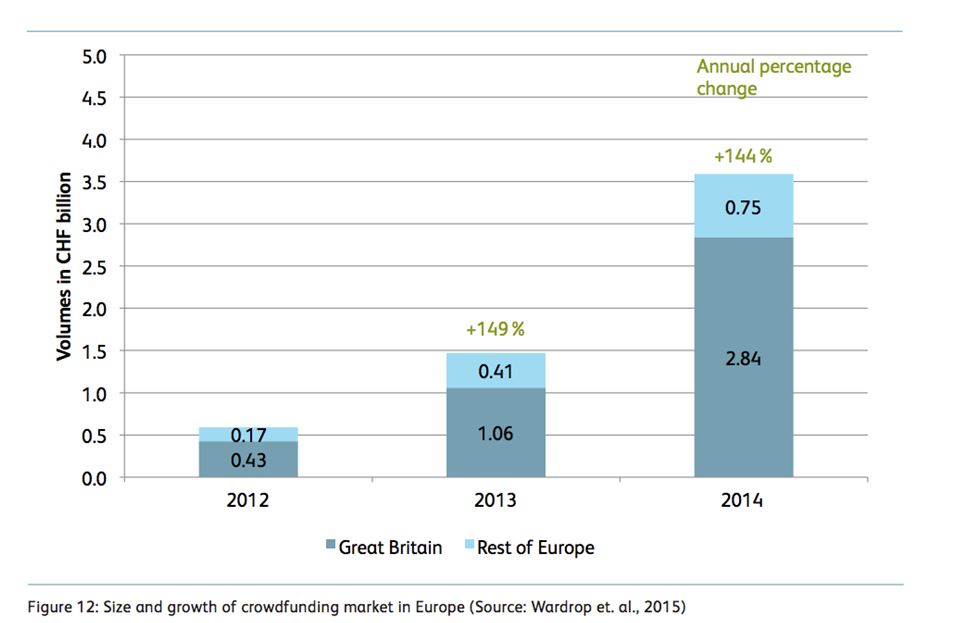

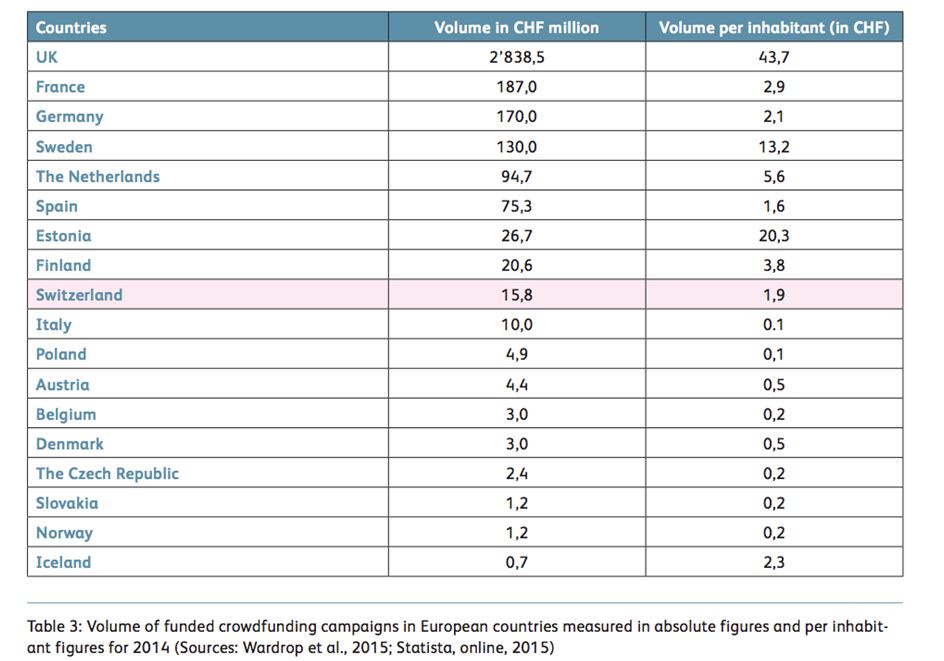

While the local crowdfunding market demonstrates great growth opportunities, Prof. Dr. Dietrich argues that the Swiss market is still lagging behind the likes of the US or the UK.

The UK is currently leading the European market with CHF 2.8 billion raised in 2014, the highest volume by far.

The country currently accounts for approximately 80% of the European market in 2014, with an impressive year-to-year growth rate of 168%.

Among 27 European countries studied, Switzerland comes in the 9th place in terms of volume, behind major players such as the UK, France, Germany and Sweden.

Read the full report here

https://blog.hslu.ch/retailbanking/files/2015/05/Crowdfunding-Monitoring-2015-English.pdf

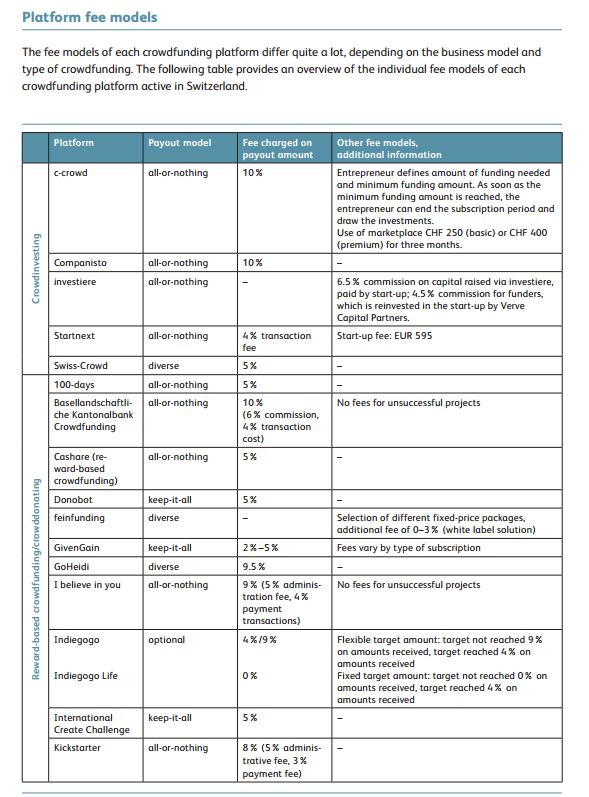

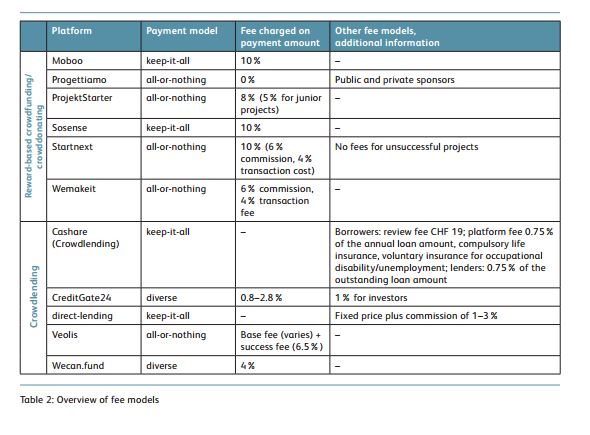

Annex: Swiss Crowd Platform Fee Models

[…] recent study conducted by the Institute of Financial Services Zug IFZ of the Lucerne School of Business, […]

[…] trend matches with a recent report conducted by the Institute of Financial Services Zug IFZ of the Lucerne School of Business, which […]