Until recently, financing a project or a business involved asking a few people for large amounts of money. Now, crowdfunding, a way of raising capital by asking a large number of people each for a small amount, has switched this idea around by using the Internet to talk to thousands, if not millions, of potential backers.

ArtistShare, a US-based company launched in 2001, is reportedly the very first crowdfunding platform to be launched. Since then, a number of sites have emerged, including notorious IndieGoGo in 2008, and Kickstarter in 2009.

Today, there are literally hundreds of crowdfunding sites you can use to kick start your next project. However, not all of them have real communities and funding successes under their belt.

some Swiss players

If you are located in Switzerland, there are a few platforms you can choose from, depending on the kind of project you want to launch.

GoHeidi, a startup headquartered in Farvagny, is one of the many available and not yet well known in Switzerland.

Launched in 2014, GoHeidi provides supporters with two ways to back a project: you can either be a sponsor by simply donating money, or be a partner. Partners contribute to a collaborative goal-based process and get in return – in the event that the project’s target amount is met – a product, perks or rewards. The platform charges a 9.5% commission fee.

But before you jump on the website, you should consider that the GoHeidi is currently only available in French. Although the company said it will „very soon“ be available in both English and German, at the time being, unless you are targeting a French speaking market, GoHeidi will probably have no use for you.

Now remember, you want a platform that has a strong community, and where numerous projects were successfully funded in the past.

As of today, 34 projects have been listed on GoHeidi, among which only 6 had been fully funded. That’s a 17.65% success rate, compared to 37.46% for Kickstarter.

Fortunately, there are other Swiss crowdfunding platforms you can turn to.

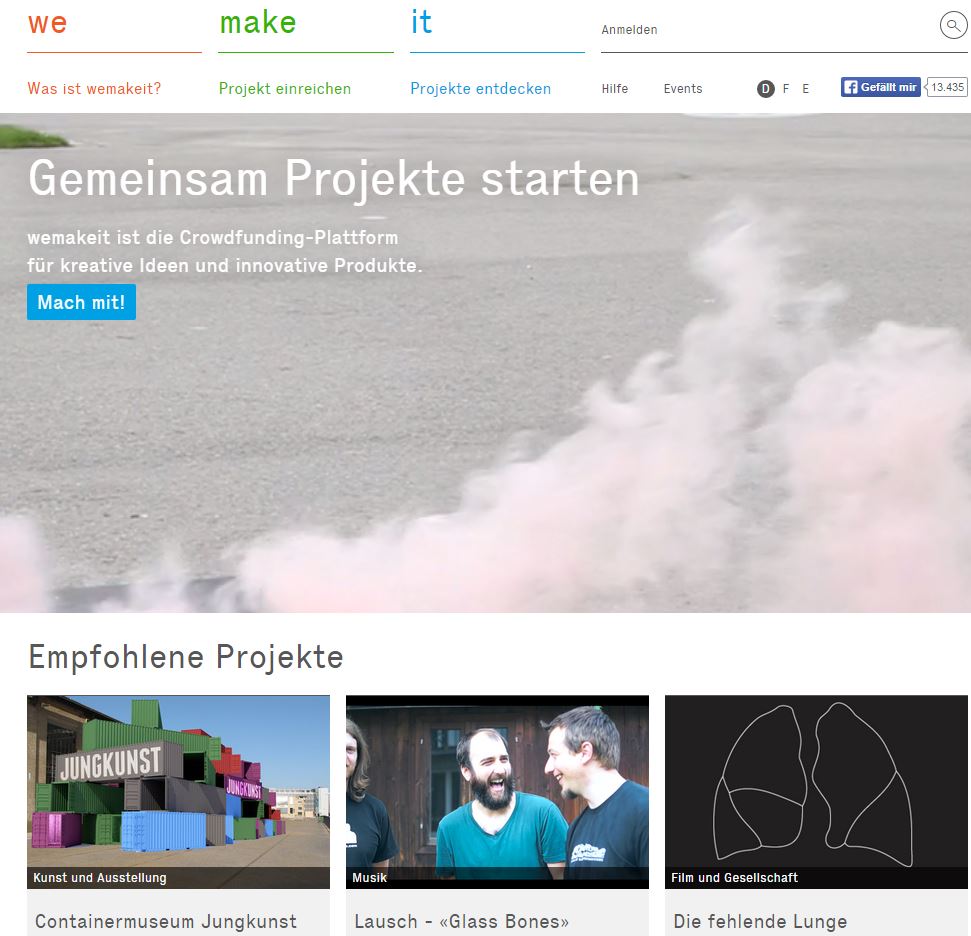

One of them is Wemakeit, the largest crowdfunding platform in Switzerland and one of the largest in Europe. Since its launch in 2012, the platform has helped fund more than 1,000 projects and claims an impressive successful rate of 70%. The site charges a 6% commission, plus 4% as a transaction fee, based on the target amount.

If you are looking to raise capital for either a creative or a sustainable project, Startnext might be the platform you’ve been searching for. The startup was mainly focused on the German and Austrian market, but is now also officially launched for the Swiss market since March.

Any creator and entrepreneur around the world can submit their project. Specific figures on campaigns success could not be found, but the platform claims to have a 500,000-member user base. StartNext charges 10% only for successful projects.

Other Swiss niche centric crowdfunding platforms include I Believe In You, a platform especially dedicated to sports projects in Switzerland, as well as ProjektStarter, a service that targets creative people under 25 years old.

In our next article we will cover some additional Swiss Crowdfunding Platforms and give a summary of a recently published Swiss Crowdfundung report.

We believe that some small Swiss Crowdfunding Platform should maybe consider to merge with other platforms to enlarge the audience. But lets come back to this thought.

[…] Popular reward-based crowdfunding platforms include Wemakeit, 100-days, “I believe in you,” as well as miteinander erfolgreich, a platform launched in late-2014, operated by Basellandschaftliche Kantonalbank, the Cantonal Bank of the Canton of Basel-Land. […]

[…] in Switzerland, 100-days, „I believe in you,“ Startnext, as well as minor ones such as GoHeidi and […]

[…] technologies and crowdfunding platforms stand as the fourth most important trends to have the potential to disrupt the currently financial […]