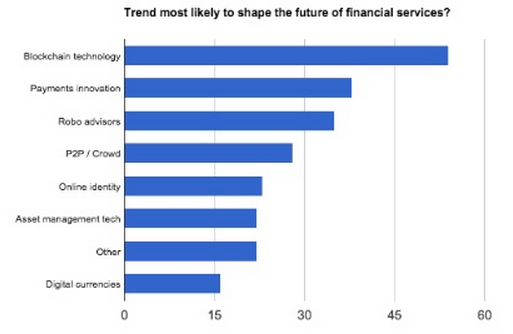

A new survey conducted by Swiss FinteCH, an association that aims to serve as the hub for the Swiss fintech scene, found that among 265 respondents, the majority believes that blockchain technology will most likely shape the future of financial services (~55), followed by payments innovations (~37) and robo-advisors (~35).

Entitled the 2015 Swiss FinteCH Survey, the study aims to gather insights and opinions of professionals and experts on the opportunities and challenges that need to be addressed in order to build a vibrant fintech ecosystem in Switzerland.

The organization collected 265 replies, predominantly from tech entrepreneurs and banking professionals from major cities in Switzerland, during May 2015.

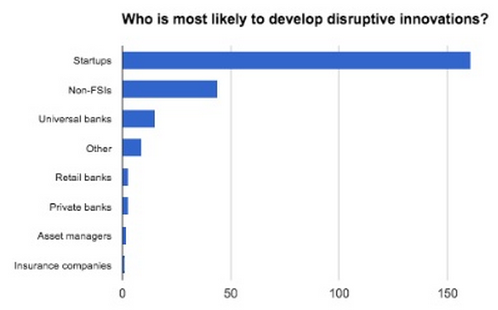

According to the respondents, startups are the most likely to develop disruptive innovations (+150), followed by non-FSIs (~45) and universal banks (~10). Respondents also believe that local fintech hubs will become the biggest competitors in Switzerland, ahead of tech companies, Silicon Valley startups and other tech startups outside of Silicon Valley. Large foreign banks are likely to be lacking behind, according to the respondents.

Overall, 76.5% believes that Switzerland currently is an important market on the global fintech scene. The country is also said to offer a prosperous environment to launch a fintech company (78.2%).

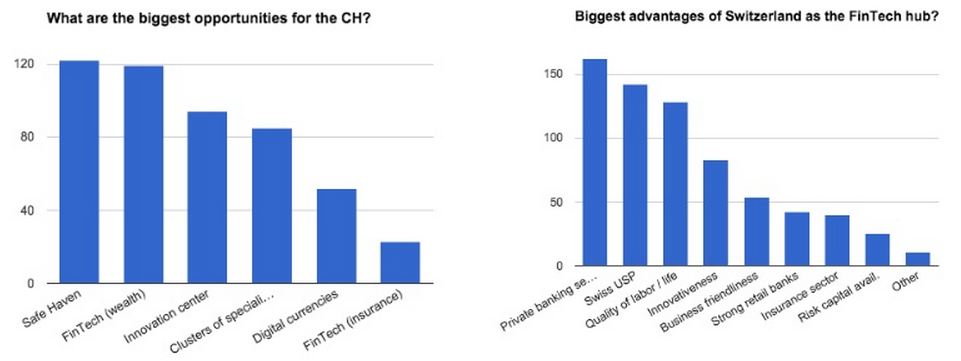

Among the opportunities for entrepreneurs to launch a fintech venture in Switzerland, respondents believe the fact that the country is a tax haven is a major element (+120). The market is also believed to be prosperous to launch a fintech startup in wealth management (~120). Switzerland is also said to be an important innovation center (~85).

The biggest advantages of Switzerland as a fintech hub are its private banking sector (~160), the Swiss USP (~140) and the local quality of life and labor (~125).

However, the biggest weakness of the country is its conservativeness (180). Respondents also believe that access to capital for companies is a challenge (+100) in addition to an overall lack of ambition (+100).

Peer-to-peer technologies and crowdfunding platforms stand as the fourth most important trends to have the potential to disrupt the currently financial services industry (25), the respondents said.

This trend matches with a recent report conducted by the Institute of Financial Services Zug IFZ of the Lucerne School of Business, which found that the crowdfunding market has experienced a promising 36% growth in 2014, a tendency that will not decelerate any time soon, according to the report.

The 2015 Swiss FinteCH Survey full report:

Schreibe einen Kommentar