Swissquote Bank AG continues to expand on the Swiss DOTS OTC trading platform. The new issuer, BNP Paribas, will add approximately 10,000 leveraged products.

This will complement the existing offering from the two founding partners, UBS and Goldman Sachs, as well as from Commerzbank and Vontobel. By contrast, Deutsche Bank will discontinue its Swiss DOTS offering at the end of the year.

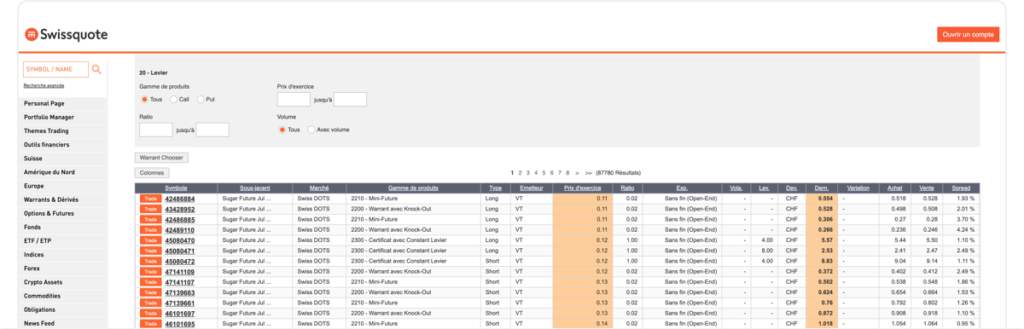

Founded in May 2012 by Swissquote, together with UBS and Goldman Sachs, the Swiss DOTS OTC trading platform is again being strengthened. As an additional issuer of leveraged products in Switzerland, BNP Paribas will join the group of partners on

Swiss DOTS. From the end of November 2019, around 10,000 leveraged products including warrants, knock-out warrants, factor certificates and mini futures, will be tradeable on a number of underlyings such as international and Swiss equities, currency pairs, indices and even precious metals.

Deutsche Bank will discontinue its activities as issuer on Swiss DOTS as from 31 December 2019. The reason is a strategic decision by management to realign the Bank’s activities.

Swissquote clients and PostFinance e-trading clients are already using Swiss DOTS to trade more than 90,000 leveraged products over the counter. Available on the Swissquote platform, these products can be traded directly with the issuer during extended trading hours, Monday to Friday, 08:00 to 22:00. With attractive terms, transparent trading and narrow spreads, Swiss DOTS is the ideal addition to the

existing offering from the SIX Structured Products Exchange.

Swiss DOTS is posting steady growth and on average approximately

27,000 transactions are performed via the platform each month. Market share, in terms of all transactions with leveraged securities in Switzerland, is currently around 50%.

Schreibe einen Kommentar