The bi-annual S&P Indices Versus Active Funds (SPIVA®) Europe Scorecard – Mid Year 2018 Results, analyzing fund performance data against the respective benchmarks, has been published.

For the period ending June 2018 highlights include:

- Swiss Equity Funds: In the one-year period to 30 June 2018, 67% of actively managed Swiss equity funds beat the S&P Switzerland BMI. However, this is reversed for the ten-year time horizon with 75% underperforming the benchmark.

Active funds investing in Swiss equity achieved an asset-weighted excess return of 3.5% over one year and 0% over ten years against the S&P Switzerland BMI. The average asset-weighted return indicates the performance of an average investor and mitigates the influence of smaller funds.

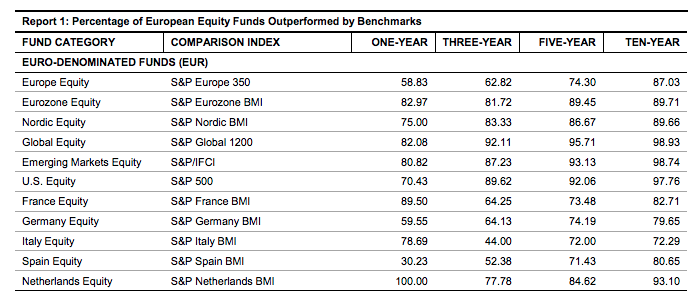

- European Equity Funds: 59% of actively managed euro-denominated pan-European Equity Funds underperformed the S&P Europe 350. This number rises to 74% and 87% over a five- and ten-year time horizon.

- US Equity Funds: 70% of actively managed euro-denominated US Equity Funds underperformed the S&P 500 over the one year period. This rises to 92% and 98% over the five- and ten-year time horizon.

- Global Equity Funds: 82% of actively managed euro-denominated Global Equity funds underperformed the S&P Global 1200 over a one-year period. This number increases over five- and ten-year period to 96% and 99% respectively.

- Emerging Markets Funds: 81% of actively managed euro-denominated Emerging Markets Equity funds underperformed the S&P/IFCI. This number increases to 99% over the ten-year time horizon.

SPIVA Europe Scorecard

Featured image credit: https://eu.spindices.com/

Schreibe einen Kommentar