WeInvest, a Singaporean fintech startup that provides a wealth management platform, wants to make information about investment products accessible and comprehensive to the average Singaporean.

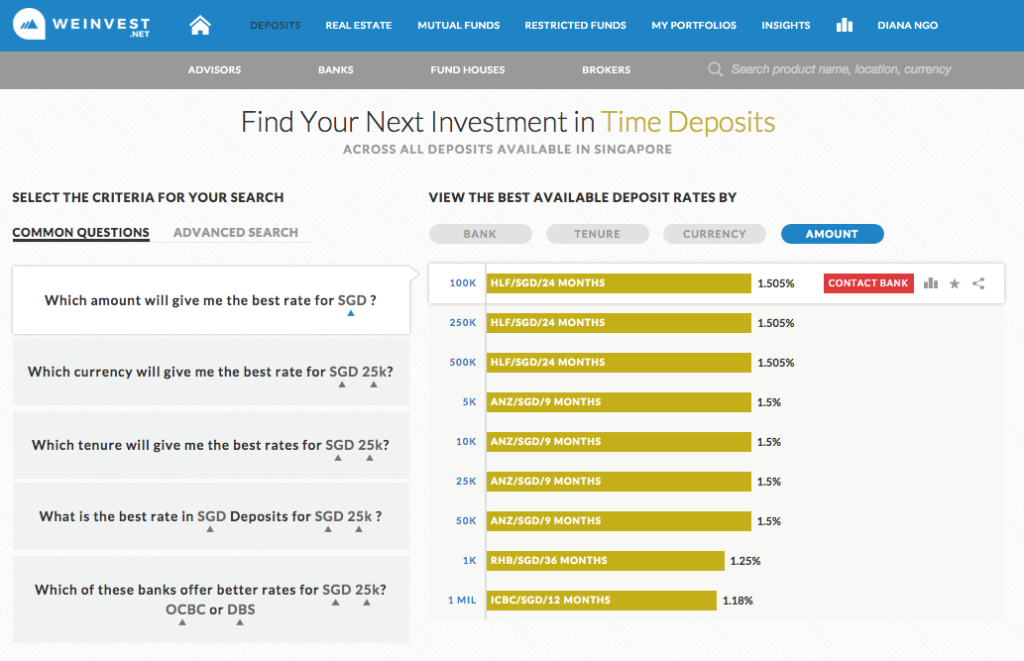

WeInvest’s platform pools and standardizes the information of available products from various financial institutions, allowing users to search and compare over 20,000 products, and eventually be referred to a broker with the best rates.

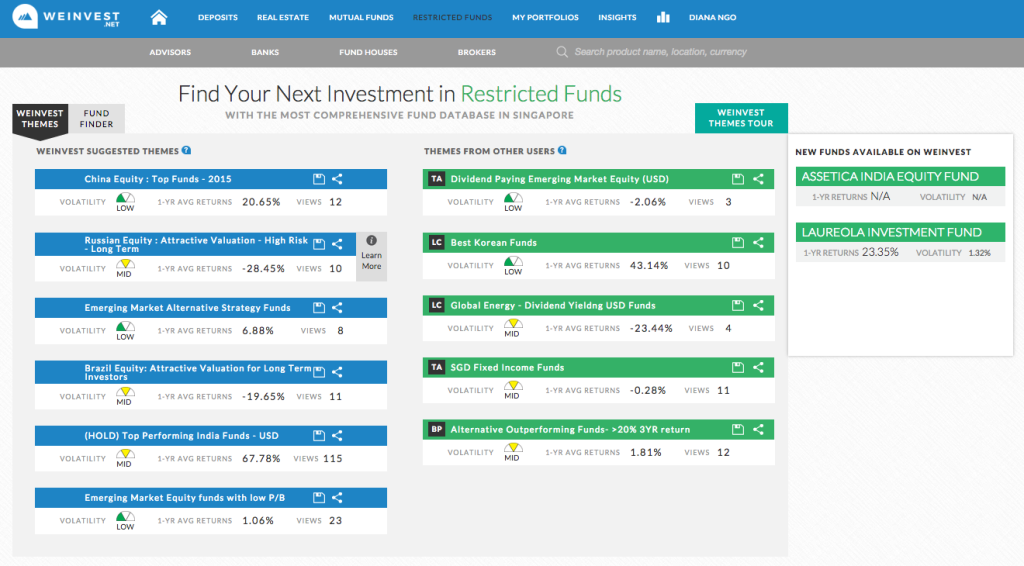

The platform currently covers four categories of investment products: Deposits, Real Estate, Mutual Funds and Restricted Funds.

Additionally, WeInvest provides a portfolio management tool that allows users to manage, track and evaluate all existing investments easily.

The purpose, the company says, is to bypass the withholding of information and empower investors.

„With investing, […] you are dependent on ‚experts‘ to tell you what to do,“ Patrick Hee, Head of User Business at WeInvest, explained in an interview.

„Many times, these experts face a principle agent problem where they are driven to sell a product, and not necessarily look out for the investor’s interest. This problem is perpetuated by the industry by making investing a seemingly complicated process, ensuring the investor’s dependence on their advice.“

To solve this issue, WeInvest curates and presents investment data in an easy-to-understand format. By providing more transparency in investment products, the company aims to create „a real open architecture for people to discover the best choice for themselves,“ according to Bhaskar Prabhakara, Founder at WeInvest.

Prabhakara further said:

„Wealth has not been an open architecture because everyone makes it so complex. It’s almost like the agent benefits out of making it so complex, so they will throw a lot of jargon and fact sheets at you.“

Led by a team of banking veterans and IT professionals, WeInvest consistently monitors the financial market for emerging trends and changing market landscape.

The company has partnered with numerous banks, brokerage houses and asset managements firms across the US, the UK, India and the Middle East, to offer a large pool of products to investors.

In order to drive up traction, WeInvest keeps its entry price really low. The platform charges as little as US$100 per month for a hedge fund to be listed. As for investors, the platform is entirely free to use and consult.

Individuals with as little as US$1,000 in savings can invest. On the other hand, estate investment opportunities, for instance, start from US$5,000 and can go up to US$5 million.

So far, the platform has managed to attract over 700 users since its launch in January. Investments worth US$5.9 million have been initiated, with half of them completed, Prabhakara told Digital News Asia.

However, while the startup is gaining much traction from both banks and individuals, it still faces the tough challenge of changing age-old finance and investing practices, he admitted.

WeInvest is now looking to raise between US$740,000 and US$1.1 million to expand its development and data teams and roll out some of the products it has in the pipeline. The startup has already secured US$518,000 of that target.

Among the new products, WeInvest is looking to launch a portfolio marketplace where users can learn from other successful investors. Additionally, the platform wants to add a new feature that would allow users to pay an extra fee to copy the trades that successful investors make.

WeInvest also plans to provide additional regional coverage and expand its investment product mix to include more product categories such as ETFs.

[…] startup WeInvest provides individual investors with tools to discover and manage their investments. The platform […]