The Millennial Generation, comprised of the people born between 1982 and 2004, is leading a generational shift, challenging and reinventing notions of trust in financial services, according to a new report from Innotribe.

Entitled ‚The Millennial Generation and the Future of Finance: A Different Kind of Trust‘, the report, authored by SWIFT’s innovation arm Innotribe in collaboration with Daniel McAuley and Steve Weiner, co-founders of Wharton Fintech, aims to provide guidance on how the Millennials will play an important role in reshaping finance.

The paper explores three main value categories defining Millennials‘ mindset and explains this generation’s consumption principles as well as how financial services companies can capitalize on the „biggest generational shift in consumer preferences ever seen.“

The paper explores three main value categories defining Millennials‘ mindset and explains this generation’s consumption principles as well as how financial services companies can capitalize on the „biggest generational shift in consumer preferences ever seen.“

Trust in technology

Millennials trust technology more than face-to-face relationships and the ‘bricks-and mortar’ user experience and are looking for new digital products that are relevant to their daily lives, according to the report.

Fintech startups such as Wealthfront, a company that provides an algorithmic personal investing platform, are responding to these new forms of trust in technology and are at the same time finding new and cost-effective ways to acquire customers, notably from the Millennial Generation.

However, while Millennials trust technology, they may also confront trust challenges in the realm of information and identity security.

„Millennials freely generate data about themselves and nearly half of them believe that businesses protect private information all or most of the time,“ the document reads. „Millennials can be particularly ineffective at safeguarding their personal data against cyber vulnerabilities.“

Taking this into account, financial industry players have to properly understand the risks associated with technology and its implementation if they want to avoid attendant threats to user data and personal identity.

Trust in networks

Digital platforms and social media play a major role in promoting products and services. Fintech startups that are leveraging trust in social networks, are generating word-of-mouth and organic customer acquisition while consistently reducing marketing costs.

An example is MatchMove, a Singaporean fintech startup that focuses on online and mobile payments. MatchMove deposits $3.88 into users’ MatchMove wallet every time they refer a friend.

By being built on the back of social networks, new entrants have „a distinct advantage over incumbents when it comes to customer acquisition,“ the report says.

„By focusing on user experience and word-of-mouth user growth these young firms are out marketing their better-funded rivals. For those financial services firms looking to gain market share within the Millennials segment, this is an extremely important approach to master.“

Trust in social causes

The growing consumer population, but most particularly the Millennial Generation, trusts companies with social or environmental objectives more than firms perceived as operating simply for profit.

This population cares about what a company does and is more likely to consider a firm’s social and environmental commitments when making financial decisions, including where and how to invest their money.

This time again, MatchMove is one of the many startups that have a social commitment. MatchMove seeks to provide access to virtual payment cards without a credit check or a minimum income requirement to the nearly half a billion underbanked people in emerging countries that have a smartphone.

„The emergence of these services means that those in emerging economies are getting more money and they are getting that money faster and with less risk.“ Additionally, „rethinking social mission is not just about acquiring Millennials as customers; it is also about attracting future talent to the workforce.“

„[65% of] university students believe that they will make a social or environmental impact in their job. While the top life goal for Millennials is to be financial secure, […] nearly 60% also cite ‚having a job with impact on causes important to me‘ (compared with fifty-two percent for Baby Boomers and forty-nine percent for Generation Xers).“

Overall, trust will still play a crucial role in the exchange of goods and services in the future. As technology evolves, financial services companies will need to evolve even quicker.

„As companies such as Wealthfront, Venmo and Wonga reinvent the way people think about and interact with their money, finance is becoming faster, cheaper and more efficient for individuals and businesses,“ the document reads.

„These firms are leveraging the explosion of technology (especially mobile), social networks and social and environmental engagement to bring financial products and platforms to Millennials while also serving those that the finance industry has traditionally underserved.“

Read the full Swift report here

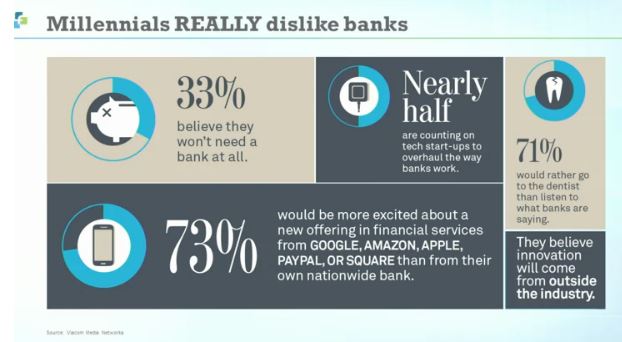

Also find here a nice Infographik from Viacom Media about Millenials and Banks.

Schreibe einen Kommentar