Indian startup CreditSeva provides online consumer credit analytics and management tools that aim to help users manage and improve their credit profiles. Not only should CreditSeva help users improve their credit scores, the startup also seeks to provide financial literacy education.

Founded in 2014, CreditSeva seeks to help consumers who are underserviced by the mainstream banks by providing three elements: providing rich financial tools;

helping them understand credit score profiling, and how they can improve that

and once they’ve improved and built their credit scores, CreditSeva helps them get finance from mainstream banks.

CreditSeva is particularly eyeing the underserviced borrower market and wants to provide guidance and expertise to consumers who are not serviced by the mainstream consumer banks. The startup has built its technology especially to fulfill this mission.

„Having worked with people who lack financial knowledge, its heart wrenching to see how they are barred from the formal lending system during critical situations due to low credit scores,“ Satya Vishnubahotla, CEO and co-founder at CreditSeva, explained in an interview.

„There are many who have lost their dream home or job, child’s education, simply because they do not know how to manage their credit debt. These people are excluded by mainstream banks and they are often left with no other means of support.“

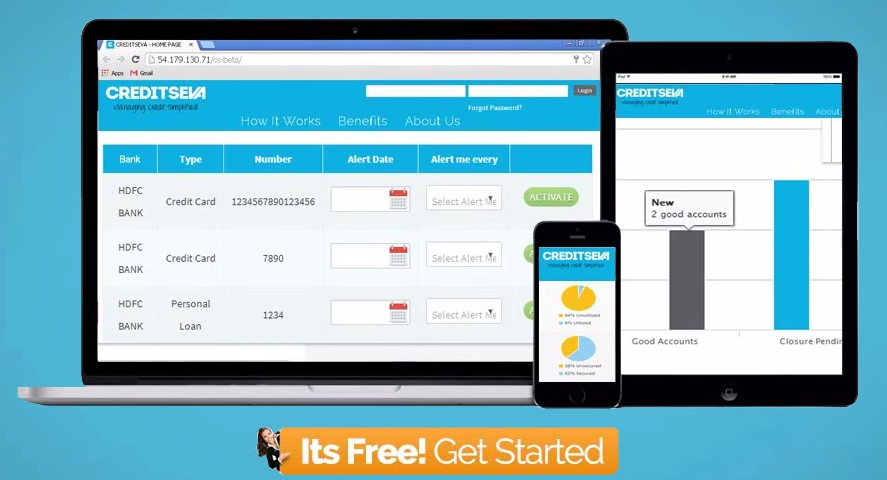

Typically, CreditSeva analyzes credit score for consumers and helps them get customized loan offers based on their credit profiles. Users can also set alerts for credit card bills or loan payments and save their valuable documents online they can retrieve any time.

Through CreditSeva, users have access to their credit reports with the details of their credit card accounts, accounts that demand immediate settlement or need to be closed or accounts that need to be rectified. The service can also communicate with banks and credit bureaus to request the rectification of any error in a user’s credit report.

The platform also allows users to connect with banks online to obtain best discounted offers to close bad loans and obtain new loan offers based on credit score.

While CreditSeva mainly focuses on the Indian market, the company seeks to find talents in Singapore, a place where CreditSeva hopes to settle a number of its corporate level functions.

CreditSeva was among the 10 companies to be selected to integrate Startupbootcamp Fintech Singapore 2015, an accelerator program that ended in July.

Through the program, CreditSeva sought to receive mentorships from top financial services executives and entrepreneurs, as well as getting the opportunity to network with banks and financial institutions and eventually scale its business to the next level.

Watch CreditSeva’s co-founder and CEO Satya Vishnubahotla’s interview with Startupbootcamp:

.

Schreibe einen Kommentar