Small and medium-sized enterprises (SMEs) are often cited as the major driver of economies and a force in job creation, accounting for more than half of the world’s gross domestic product and employing almost two-thirds of the global work force.

However, SMEs often have one major pain point: dealing with their finances and ensuring appropriate funding. Luckily, today more than ever, SMEs have access to fintech solutions, which are efficient and effective at lower scale.

Fintech represents a new set of products tailored to the needs of SMEs. These include marketplace lending, merchant and e-commerce finance, invoice finance, online supply chain financial and blockchain trade finance.

Considering the importance of SMEs, we focus today on this particular aspect of fintech with a list of fintech solutions for SMEs available in Switzerland.

——————————————————————————

Article in German here / Deutsche Version hier

——————————————————————————-

Money Transfer

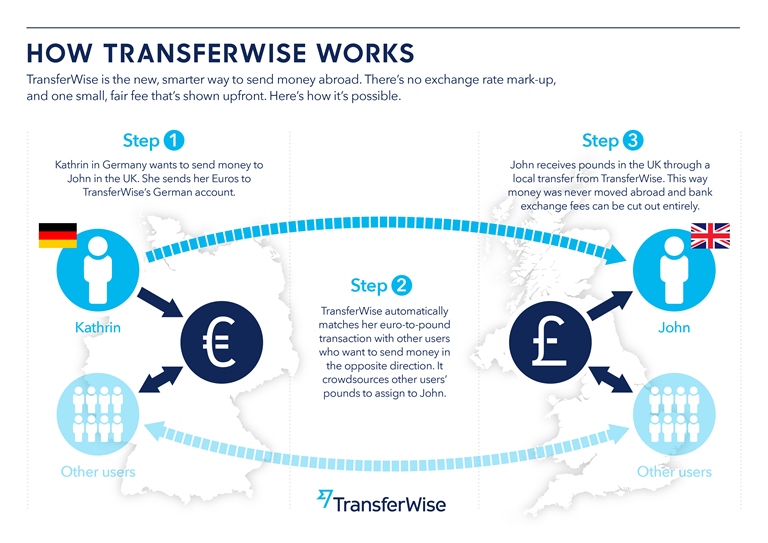

In the money transfer area, one of the names that come first to mind is TransferWise, the London-based fintech unicorn backed by the likes of PayPal co-founder Max Levchin, Peter Thiel, Richard Branson and leading ventures firms such as Index Ventures, IA Ventures and Andreessen Horowitz.

Launched in 2011, TransferWise is a peer-to-peer money transfer service that relies on an innovative concept: instead of transferring the sender’s money directly to the recipient, it is redirected to the recipient of an equivalent transfer going in the opposite direction. The recipient of the transfer then receives a payment not from the sender initiating the transfer, but from the sender of the equivalent transfer.

This process avoids costly currency conversion and transfers crossing borders.

TransferWise supports more than 300 currency routes across the world.

Marketplace Lending

Marketplace or peer-to-peer lending refers to the practice of lending money to borrowers without going through a traditional financial intermediary such as a bank.

The SME marketplace lending market remains limited in size and scope accounting for US$60 billion to US$70 billion in 2014; compared to total bank lending to SMEs of US$14 trillion to US$18 trillion during that same year.

Nevertheless, the industry is growing fast and is projected to experience notable future growth rates, according to the World Economic Forum.

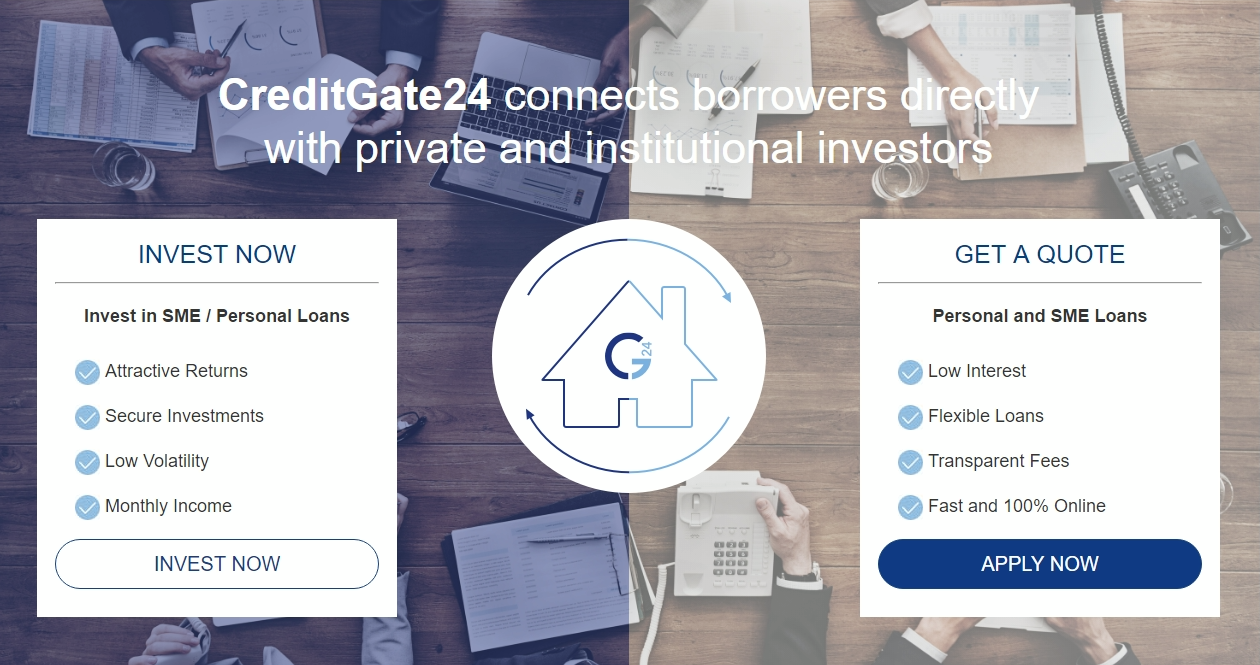

CreditGate24 is probably the most important player in Switzerland’s crowdlending industry. According to P2p-Anlage.de, Creditgate24 has the highest credit volume in Switzerland. The company provides a platform for personal loans and SME financing. It brings borrowers and lenders/investors together on a highly automated direct-lending platform. This loans can be used for Development and Growth.

An other important service is the Liquidity Management. SMEs often struggle to get overdraft facilities, need to pay excessively high interests if they get an overdraft facility or are forced to use expensive factoring arrangements.

Here the company try to help out. The last service for SMEs is Refinancing. Loans, Leasing, Factoring or bank overdrafts are often very expensive for an SME. The loans from the ones like CreditGate24 are usually a much cheaper and a better solution than the existing bank loan or factoring solution.

Other Swiss crowdlending platforms targeting SMEs in Switzerland include Creditworld and Swisspeers.

Money Management and Liquidity Management

Another international payments and currency exchange specialist is the Swiss fintech startup Amnis Treasury Services which focuses on providing SMEs with treasury services, risk management, advisory and related services.

Amnis allows SMEs to settle foreign exchange transactions on the same terms as large companies, while providing full transparency regarding the fees. The platform operates on a peer-to-peer business model, bypassing banks and reducing costs and administration time for clients.

Invoice trading

Invoice trading platforms allow businesses to sell individual invoices in order to free up cash and solve cash flow issues, to an online community of investors. Platforms such as Advanon take the principle of peer-to-peer lending and applies it to invoice finance.

Advanon is an online platform on which SMEs looking for short-term financing can sell their invoices to financial investors. For sellers of invoices, the platform provides flexibility, transparency, speed and convenience. For investors, Advanon provides them with access to investments that are short-term and securitized, and a platform that is easy to use.

Advanon is a strategic partner of Hypothekarbank Lenzburg.

Accounting

Online accounting software is a great option for small businesses, which don’t need expensive software to manage a general ledger and basic business accounting tasks.

Among the solutions available out there, bexio is a web-based application that lets you write invoices, manage orders and manage customers easily.

Via Vimeo

The platform provides smart bookkeeping and comes with a number of add-ons and an API.

bexio packages start at only CHF 29 per month and you get to try the platform for 30 days for free. bexio currently serves some 60,000 small businesses, startups and self-employed individuals.

Another option is Run My Accounts, another accounting software for SMEs and startups.

FundRaising

For companies that are looking to raise funding, Switzerland has got a number of available platform. They include investiere, an online venture capital investment platform launched in 2010 by Verve Capital Partners, a company based in Zug.

Via investiere’s Twitter

investiere aims at facilitating investments in Swiss startups. In just a few years, the solution has managed to become one of the leading European online investment platforms for private investors.

Another solution is DealMarket, a global online platform for fundraising and deal flow management. Launched in 2011, the platform now counts more than 15,000 active private equity professionals from 159 countries. DealMarket’s deal flow management solution is used by global leading banks such as UBS.

Featured image: via Pixabay

Schreibe einen Kommentar