Credit Suisse Launches Global Digital Private Banking Capabilities with Asia Pacific Release in Singapore.

Credit Suisse previously announced that it is committed to making significant investments in expanding its client facing technology globally to enhance clients’ access to portfolio analytics, research and market data, collaboration and transaction services, starting in Asia Pacific.

Today’s launch marked the first milestone in this commitment with the release of a Credit Suisse Private Banking Asia Pacific app. The new digital platform represents a new private banking service delivery model, and empowers clients with round-the-clock access to comprehensive information about their accounts, market insights and intelligence personalized according to their portfolio, while supporting them with trading tools that enable them to respond to moving markets.

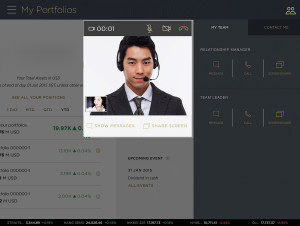

Designed with a simple user interface, the new digital private banking solution also facilitates multiple channels of connectivity and collaboration for clients with their relationship manager and Credit Suisse team.

The key features of the Credit Suisse Private Banking app include:

- My Portfolios: At-a-glance overviews of portfolio valuations and performance liquidity and available funds to invest, asset and currency allocations, income and expenditure, and histories of transactions and cash activities

- Watchlist: A watchlist that helps clients monitor their selected instruments across asset classes, and access related Credit Suisse research as well as third party sourced indicators

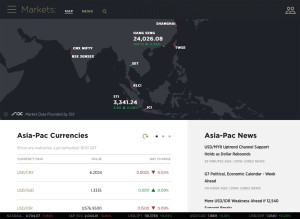

- Markets: An overview of global and regional markets news, major indices and company information, and latest global asset classes performances across currencies, bonds and commodities

- Ideas: Access to the library of Credit Suisse Investment Strategy and Research publications

- Collaboration: A built-in suite of collaboration tools that facilitate connections between clients and the Credit Suisse team, including instant messaging, audio and video call, screen and document sharing and document annotations

- Trade: Trading in securities (equities, ETFs and REITs) and spot foreign exchange Initially available on the iPad, access will be extended to other devices, including the Apple iPhone, web browsers, and devices operating on Google Android.

Screenshots:

It will also be rolled out progressively to clients in Singapore and across Asia Pacific. New features and enhancements will be released in phases, for example tools for portfolio analysis,greater trading capabilities and alerts based on clients’ preferences.

It will also be rolled out progressively to clients in Singapore and across Asia Pacific. New features and enhancements will be released in phases, for example tools for portfolio analysis,greater trading capabilities and alerts based on clients’ preferences.

Beyond Asia Pacific, Credit Suisse will roll out its digital private banking platform in other regions, including USA, Switzerland and Europe, through this year and next.

At the launch in Singapore, Francesco de Ferrari, Credit Suisse’s Head of Private Banking Asia Pacific said,

“I am delighted that Asia Pacific has been chosen as the first region to launch Credit Suisse’s new digital private banking capabilities. Asia Pacific is the fastest growing region for our Private Banking business, with some of the biggest and most rapidly expanding wealth pools in the world. However, as Private Banking is a relatively nascent industry in the region, we also face the challenge of having a sufficient talent pool to cater to the demand in wealth management services.

A digitalized multi-channel service delivery model will bring the relationship manager and bank significant gains in efficiency and higher value-added productivity, and most important of all, enable us to serve our clients better and cultivate deeper client relationships.”

According to a 2014 survey 82% of high-net-worth individuals in Asia Pacific expect their wealth management relationship to be conducted entirely or mostly through digital channels, while 83% of them said that they are far more likely to leave wealth management firms that cannot offer an integrated digital and direct channel experience.

Credit Suisse’s digital private banking solution was developed in Singapore where the bank’s largest private banking operations outside Switzerland are based, which is also the bank’s largest hub in the region. An Innovation Hub was set up on one of the bank’s premises in Singapore last year, where a development team of around 200 employees and vendors have been working closely to develop and deliver the new platform.

Video:

Schreibe einen Kommentar