The use of social media is ever-increasing with over 4.5 billion people actively using social media in 2021.

In fact, social media has become the most popular way investors research investment ideas according to the CNBC/Momentive Invest in You Survey, with over a third of new investors beginning to integrate it as part of their investment decision process in 2020 or later. Roundhill Investments, a pioneer and innovator in the ETF space, now releases the Roundhill MEME ETF (ticker: MEME), a social media-based strategy tapping into this momentum.

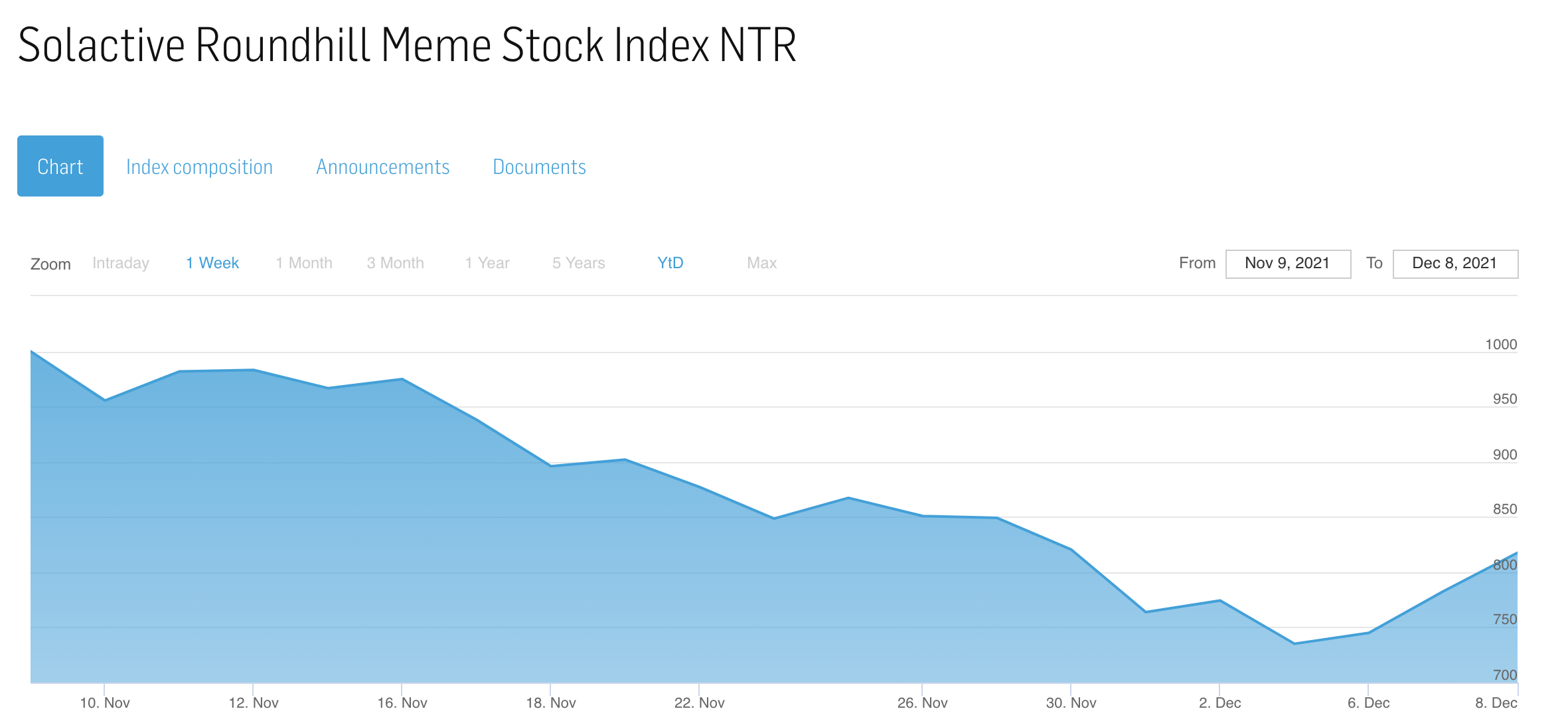

The Solactive Roundhill Meme Stock Index serves as the underlying of the Roundhill MEME ETF. This index is composed of the top 25 U.S. listed securities ranked by Meme Stock Score and levels of short interest as a percentage of float. Meme Stock Score is measured based on recent discussion activity on the WallStreetBets Reddit forum, as provided by Quiver Quantitative. All constituents must fulfill a minimum free-float market capitalization of USD 1 billion to be eligible for inclusion. The index is equally weighted and rebalanced twice per month.

The Roundhill MEME ETF started trading on New York Stock Exchange on December 8th, 2021.

Schreibe einen Kommentar