ETF Managers Group in partnership with PureFunds has announced their newest fund, the PureFunds Solactive FinTech ETF (FINQ).

Trading on the NASDAQ, FINQ invests in global companies disrupting the multi-trillion dollar financial industry by offering technology-based solutions designed to revolutionize how financial industry firms interact with their customers and run their businesses.

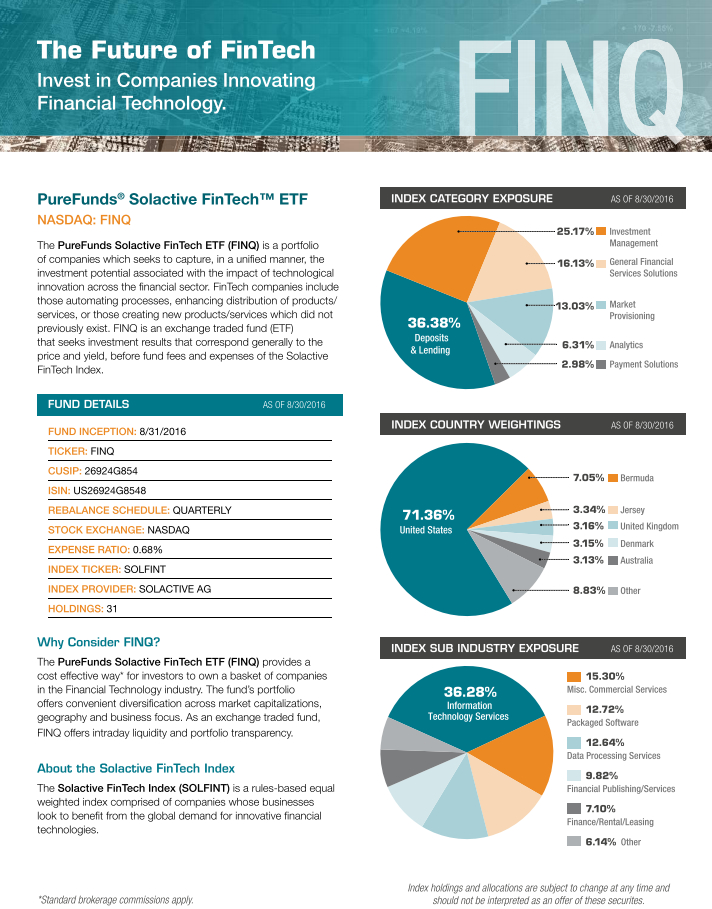

The fund’s holdings include technology services companies that principally derive revenue from the sale of financial-related information, financial data analysis services, financial services software tools or platforms or web-based financial services. Each company in the fund and its corresponding index – 31 in total – has a minimum market cap of $200 million.

“Financial technology is a rapidly growing subsector of the overall financial services industry, and FINQ seeks to tap into the potential investment opportunity created by these disruptive, forward- thinking companies,” Andrew Chanin, CEO of PureFunds, said. “FINQ allows investors to invest in this fast-growing segment of the industry without having to select individual companies. The rules- based index approach allows us to capture exposure to companies at the forefront of innovation in the financial industry.”

Sam Masucci founder and CEO of ETF Managers Group said, “The idea behind PureFunds ETFs is to make available – in a single diversified investment – unique areas within markets that have been greatly enhanced by technology. Technology allows businesses to offer new innovative services that can positively affect a consumer’s experience.”

FINQ will cost 68 basis points and will be equal weighted. It joins PureFunds’ suite of products, BIGD, GAMR, HACK, IFLY, IPAY, SILJ and IMED, which also begins trading today on the NASDAQ.

Schreibe einen Kommentar