Fidelity Investments, one of the largest index mutual fund providers with over $7 trillion in total client assets, announced last August a series of industry-changing moves.

Fidelity’s enhancements include:

- Zero expense ratio mutual funds (Fidelity ZERO Index Funds)

- Zero minimums to open accounts

- Zero account fees

- Zero domestic money movement fees

- Zero investment minimums on Fidelity retail and advisor mutual funds and 529 plans

- Significantly reduced and simplified pricing on existing Fidelity index mutual funds

Kathleen Murphy

„Fidelity is once again rewriting the rules of investing to deliver the unparalleled value and straightforward investing options that individuals need and deserve,”

Said Kathleen Murphy, president of Fidelity Investments’ personal investing business.

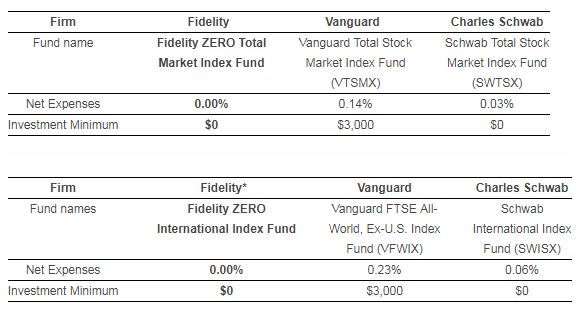

- Zero Expense Ratio Fidelity ZERO Index Funds. Fidelity ZERO Total Market Index Fund (FZROX) and Fidelity ZERO International Index Fund (FZILX) are the industry’s first self-indexed mutual funds with a zero expense ratio available directly to individual investors. This means investors will pay a 0.00% fee, regardless of how much they invest in either fund, while gaining exposure to nearly the entire global stock market. The funds will be available on Fidelity.com as of Aug. 3, 2018. For more information on these funds, click here.

- Zero minimums to open accounts; zero account fees; and zero domestic money movement fees for individual investors. Investors of all ages and affluence crave an investing approach and fee structure that is straightforward and simple. Fidelity is taking a leading approach in the industry by implementing across-the-board zero investment minimums to open a Fidelity retail brokerage account (including the Attainable Savings Plan) as well as eliminating account and domestic money movement fees on these accounts. For example, Fidelity will not charge individual investors for domestic bank wires, check stop payments, returned checks and low balance maintenance fees. These changes are effective immediately.

- Zero investment minimums on Fidelity mutual funds and 529 plans. Fidelity will impose no investment minimums on its mutual funds and 529 college savings plans available to individual investors directly from Fidelity or through a financial advisor. These changes are effective immediately.

- Reduced and simplified pricing on existing Fidelity index mutual funds. In addition to offering the industry’s first self-indexed mutual funds with a zero expense ratio, Fidelity is reducing the pricing on its existing stock and bond index mutual funds. Fidelity will provide investors the lowest priced share class available, ensuring every investor, regardless of how much they invest, will benefit from the lowest possible fees. The average asset-weighted annual expense across Fidelity’s stock and bond index fund lineup’s will decrease by 35 percent, with funds as low as 0.015 percent.These changes will save shareholders approximately $47 million annually.

Featured Image via Freepik

Schreibe einen Kommentar