ETFGI, an independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported that ETFs and ETPs listed in the Middle East and Africa saw net outflows of US$249.36 million in January.

Assets invested in the Middle East and African ETF/ETP industry finished the month up 7.91%, from US$29.14 billion at the end of December to US$31.44 billion, according to ETFGI’s January 2019 the Middle East and Africa ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the Middle East and African ETF/ETP industry rise 7.91% in January.

- During January 2019, ETFs/ETPs listed in the Middle East and Africa saw US$249.36 Mn in net outflows.

- Products providing exposure to commodities attracted the greatest net new assets during the month.

By the end of January 2019, the Middle East and African ETF/ETP industry had 746 ETFs/ETPs, from 45 providers listed on 14 exchanges. Following net outflows of $249.36 Mn and market moves during the month, assets invested in the Middle East and African ETF/ETP industry increased by 7.91% from $29.14 Bn at the end of December, to $31.44 Bn.

Growth in the Middle East and African ETF and ETP assets as of the end of January 2019

Equity ETFs/ETPs listed in the Middle East and Africa saw net outflows of $242.28 Mn in January, less than the $279.31 Mn in net outflows equity products had experienced by the end of January 2018. Fixed income ETFs/ETPs listed in the Middle East and Africa saw net outflows of $65.51 Mn in January, less than the $17.44 Mn in net inflows fixed income products had attracted by the end of January 2018.

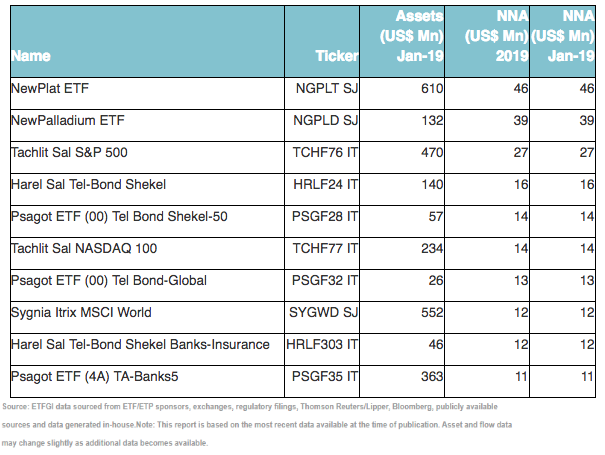

Substantial inflows can be attributed to the top 10 ETFs/ET’s by net new assets, which collectively gathered $203.39 Mn in January, the NewPlat ETF (NGPLT SJ) gathered $45.92 Mn alone.

Top 10 ETFs by net new assets January 2019: Middle East and Africa

Schreibe einen Kommentar