Distributed ledger technologies expert, Decentriq has collaborated with cutting edge index provider LIMEYARD to develop the Crypto Asset Index (LYCAI).

Combining their joint crypto asset market experience and knowledge, the index reveals the top 20 Securities and Exchange Commission concerns.

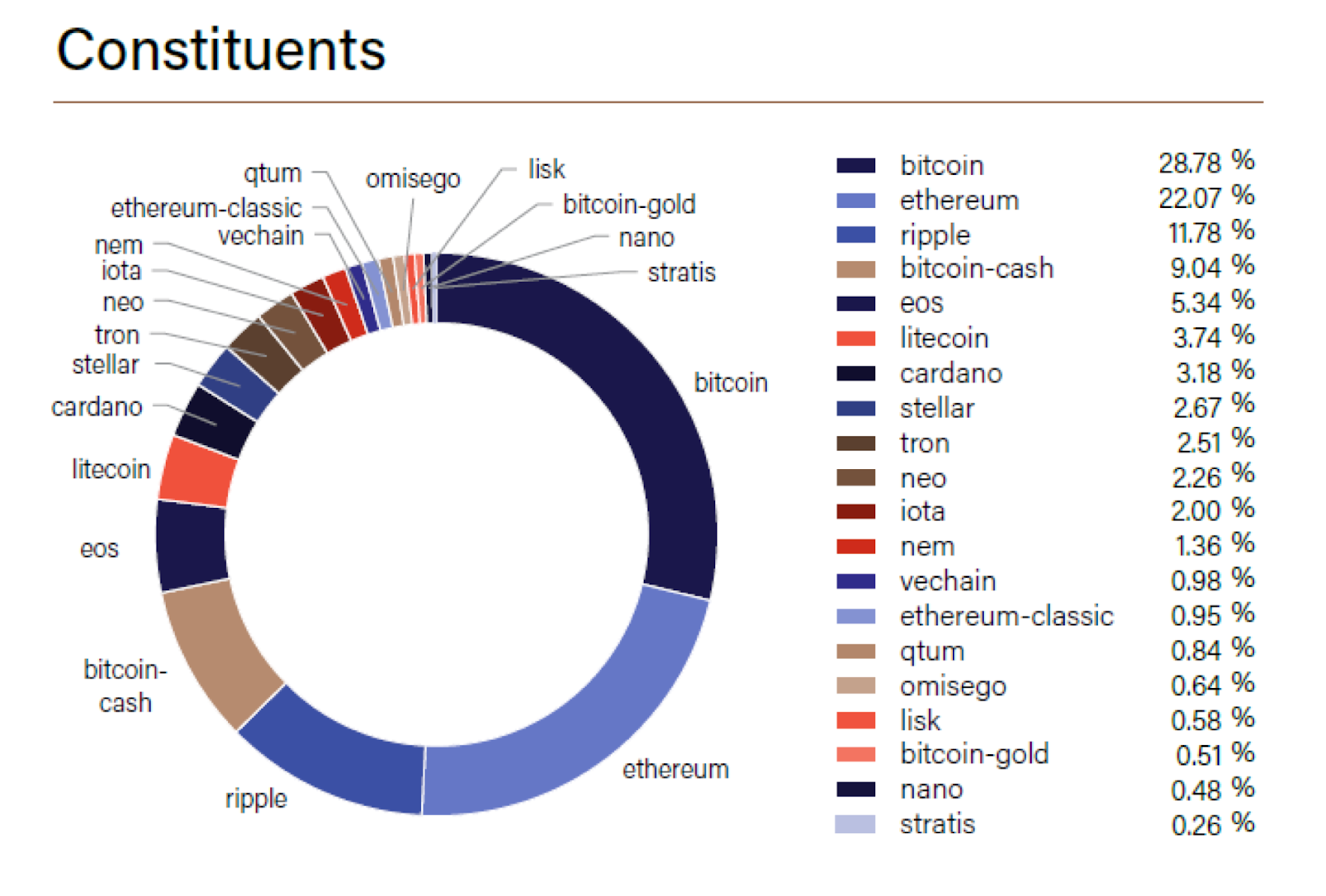

As thought leaders and data-driven entities, Decentriq and LIMEYARD aim to enrich the crypto discussion in relation to asset management. Decentriq has provided historical data as well as market knowledge and insights, in order to assure first-rate results. Crypto market, by analyzing the top 20 crypto assets. The index is calculated real-time.

The Crypto Asset Index has been designed to represent the crypto asset market while addressing regulatory and compliance concerns. The Index has been published as a benchmark for the Blockchain Technologies Note (DE000A19VT92), listed on the Frankfurt Stock Exchange. It is available for licensing by other financial products.

Stefan Deml, Co-Founder of Decentriq, comments:

We’re delighted to join forces with LIMEYARD, combining our knowledge of the crypto market and their decades of experience in the index

business, to build the first index representing so well the nascent, yet growing crypto asset class.

Patrick Valovic, Founder and Managing Partner of LIMEYARD, explains:

Our team has built this index considering the needs of regulators, who have made some ETF proposals because their methodology was too simplistic, and players could run them. Excluding crypto assets which are enabling anonymity is thus a way to ensure that any product is based on this index.

The rules-based methodology can be summarized as follows:

- The universe is crypto assets (coins or token) traded at least two out of 13 eligible exchanges. Crypto assets enabling anonymity are precluded, as well as those pegged to fiat currencies.

- To be included in the Index, components are screened to ensure their investment (daily trading volume) and reduce their volatility (exponentially moving average of the daily market capitalization).

- The Index is composed of the top 20 components passing thesis screenings.

The index is calculated both in USD and in BTC. Public information is used to build the index.

The Index is calculated in real-time 24/7 and disseminated from 4 am to 10 pm (CEST) 24/7 by the Vienna stock exchange. The Index is rebalanced monthly and reviewed annually. ISIN: CH0418626138 and Bloomberg ticker: LYCAI2UP index.

The Crypto Asset Index is calculated and owned by LIMEYARD. Decentriq is acting as a data provider.

Schreibe einen Kommentar