Sending money abroad is no hassle-free task, especially with immigrants who try to work hard to earn money and sending it back to their families.

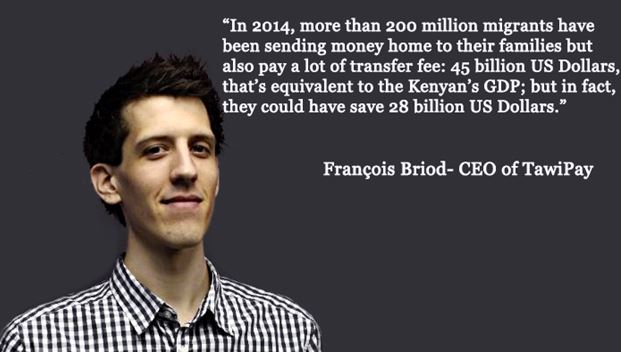

While the number of immigrants sending money abroad are still on the rise, the transferring fees do not seem to go down; not to mention how unaware of these users of how international money transfer actually, those users have been wasting lots of their money on the transferring fees alone while they actually can save more than that.

Fed up with this fact, the Briod brothers François and Pascal, together with Laurent Oberholzer, came up with the first foundation for a product that can

empower migrants with clear, transparent and complete information to help them find the best money transfer service for their needs

the Swiss based company TawiPay.

Appeared on the market on 2013, just like its fellow competitors (FXcompared, SendThatCash), TawiPay is a comparison website in which the users can compare all of the available transfer options to get the best deal, including Money Transfer Disruptors such as as Currency Fair or Transferwise. (Check: Cutting out the Banking middle man in money transfer)

Tawipay makes money in the same way as other comparison websites: through lead/ transaction that were affiliated to TawiPay website.

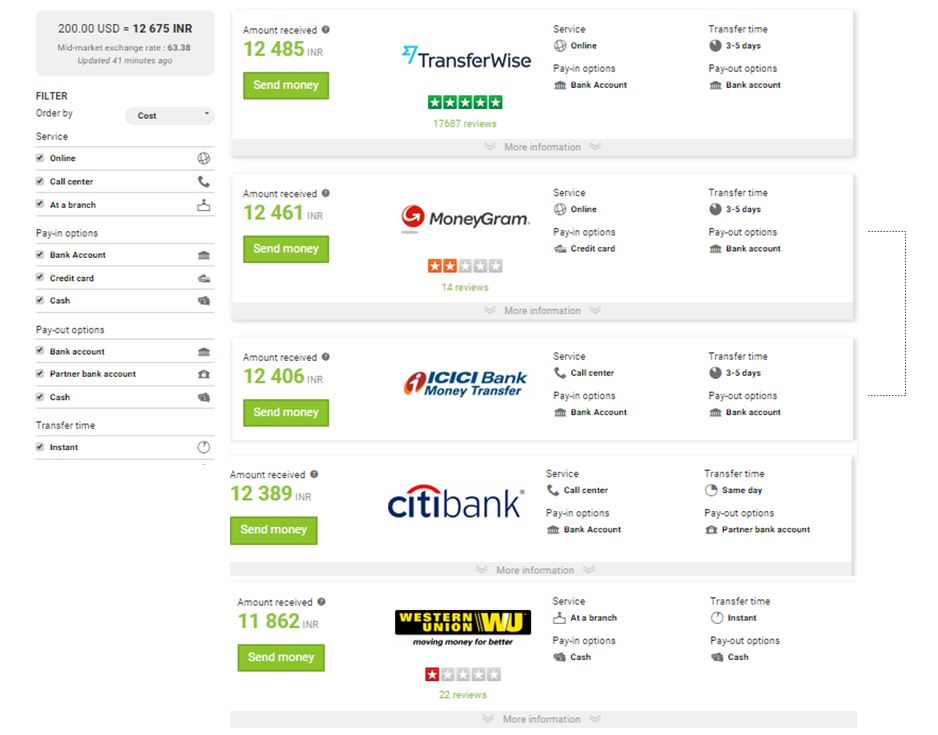

In this example we can see that if somebody from USA want to send USD to India, the amount the people will get in India can clearly be different. Transferwise pays out 12’485 IDR, Citibank 12’389 IDR and Western Union only as little as 11’862 IDR.

Check this link for full comparison.

What makes TawiPay stand out among other websites when their platforms are somewhat the same (since their main purpose is to help comparing the deals)? TawiPay’s platform does not stop at comparing the rate only, every function of it is developed based on “transparency”.

One of the reason that makes transfer fees differ among transfer operators is the hidden fee (normally the exchange rate margin). Although this fee can go up to 50 percent of the total fee the users must pay, not many are aware of it. Meanwhile, for TawiPay users, the customers can clearly see what are included in the transfer fee:

Because the exchange rate is continuously updated on the website, TawiPay users can easily calculate the total money he has to pay for the transaction as well as the total number of how much his family will receive; and thanks to the complete information regarding the transaction (service, transfer duration, pay-in/ pay-out options), the users can now compare the deals with ease.

TawiPay also has its own blog, on which uploaded all articles relating to international money transfer which the users must know before any of their transaction like: “dirty secret 0 fee”, explanations of remittance, transfer speed, etc. Every question that you have had already been served on the blog. With everything already revealed on the plate, questioning TawiPay’s credibility is unthinkable.

Recently, Migreat the web and mobile platform for migrants, has partnered with Tawipay, offering a more transparent to the money transfer.

We need to reach in an efficient way millions of migrants around the world with our offering and provide them the best advices possible for their money transfers. If we succeed, we’ll see a drastic change in the price of remittances services and more competition in the market.

François commented.

[…] Tawipay, a comparison site for remittances services, won the pitch competition. Alongside Tawipay, the nine other startups that participated were: […]