Swiss-based ECUREX has become the first bitcoin trading platform to be fully compliant with the Swiss Banking Act. The news broke on May 19, following sixteen months of investigation by the Swiss Financial Market Supervisory.

The exchange has passed the second and final step into becoming the very first fully legitimized and authorized digital currency exchange operating in Switzerland.

ECUREX has already been compliant with the Swiss Anti-Money Laundering Act, AMLA, since April 2014. Now the compliance with the Swiss Banking Act represents a significant milestone for the company and demonstrates its commitment to industry best practices, ECUREX said in a release.

Legal status of bitcoin in Switzerland

In Switzerland, digital currencies such as bitcoin, are considered equivalent to any other foreign currency. This particular classification implies that exchanges and trading platforms such as ECUREX, are financial intermediaries. Thus, these entities must comply with both the Swiss Anti-Money Laundering Act, AMLA, and the Swiss Banking Act.

„Switzerland probably has the most challenging regulatory environment for such a business,“ Paolo Tasca, CEO of ECUREX, said. However, a clear and stable regulatory environment is beneficial for both businesses and customers, he added.

In June, Switzerland became the latest European country to rule that bitcoin is exempt from value-added tax, following recent similar rulings from the likes of Spain, Finland and Belgium.

The Swiss Federal Tax Administration (FTA) stated its official position after clarification was requested from a pro-bitcoin group. The FTA’s ruling signifies that Switzerland recognizes bitcoin as both explicitly legal and a legitimate currency.

The local bitcoin community enthusiastically welcomed the move. Erik Voorhees, founder of Switzerland-based cryptocurrency exchange ShapeShift, praised the country’s „measured and reasonable stance on bitcoin.“

„This is helpful to our business as prices can be more competitive – ultimately the avoidance of any tax is good for individuals and business and makes the market more productive as less capital is extracted from it,“ Voorhees told CoinDesk.

The future of bitcoin

According to Tasca, Switzerland’s position as a financial leader and its advanced technology industry, represent an „extraordinary environment“ for the development of the fintech community and especially for bitcoin and blockchain startups.

„Bitcoin-related ventures represent a relevant portion of this community by holding attractive opportunities for any party involved in the digital transformation of both financial and non-financial sectors,“ he told LeapRate.

The disruptive nature of blockchain technology has the potential to shake up multiple industries, from payments, remittances, trading, to asset record keeping and transferring, intellectual property ownership and data storage.

A number of Wall Street bankers have already set sight on digital distributed ledger technologies, including former JP Morgan credit default swap pioneer Blythe Masters.

Earlier this year, Masters was appointed CEO of Digital Asset Holdings, a fintech startup that provides blockchain-powered tools to track and settle both digital and mainstream financial assets.

Speaking at Exponential Financial 2015, she explained how distributed digital ledgers will fundamentally change the way our financial world operates:

„Economic transactions on a digital ledger can be programmed to record virtually anything of value.[…] This means the entire life cycle of a trade, including its execution, the netting of multiple trades against each other, reconciliation of who did what with whom, and whether they agree, can occur at the trade entry level.

That’s much earlier in the stack of process than what you are accustomed to seeing in mainstream financial infrastructure.“

Masters concluded:

„How seriously should you take this? I would take it about as seriously as you should have taken the concept of the Internet in the early 1990s. It’s a big deal. And it is going to change the way our financial world operates.“

Watch Masters‘ brief highlights:

More information about Ecurex you can find here

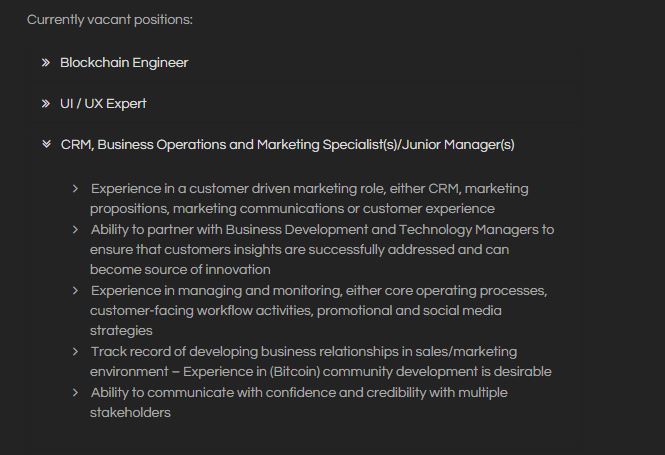

Open Jobs at Ecurex

Stay tuned about Swiss Fintech News. Check www.fintechnews.ch

[…] relevant example is the case of ECUREX, a Swiss-based bitcoin trading platform, which took 16 months of assessment before obtaining legal […]