Is there any solution to trade for zero-fee? In 2014 the US traders received good news from a new zero-fee trading app, which went live more than a week ago and has already 800’000 people on their waiting list.

Lots of people discussing about RobinHood these days, they try the app and give comments of their thoughts. So what and how RobinHood is used?

The first time I heard about RobinHood app from my friends, I though it should be a game that allows people experience a life as RobinHood, a prince or a thief.

In fact, RobinHood app is a trading app on iOS, it attracts people’s attention by its very impressive concept “Start investing, stop paying”, simple and clear. Unlikely in the 20th century and early 21st century, trading stock market costs traders billion$ of comission every year for buying or selling their shares.

After more than two years of development, $16 million in funding and 800’000 people in their waitlist, RobinHood finally was launched in December 2014. Few months later, its team reported in their blog that their customers have economized $5 million in commissions and more than $212 million has been traded through RobinHood’s platform.

RobinHood was founded by Vladimir Tenev, and Baiju Bhatt. They are math nerds and were roommates at Stanford University and previously worked for a High Frequency Trading Company.

10’000 account opening a day!

The founders are planning for about 10’000 new account openings everyday once the app premieres, according to Forbes, because as Bhatt notes: “Our goal is to make the public markets more available to more people”.

Business Insider writes about the app: “it’s sleek and easy to use. It’s designed to give first time, small scale investors a leg up on Wall Street hotshots.“

Check out the animation video of this app:

The College Investor Blogger described RobinHood app with illustration pictures captured from his iPhone screen for every step.

He studied and shared how RobinHood makes money: “They have two models. First, they don’t pay you interest on any money left in your account. Rather, they collect the interest on that money and keep it for themselves. They also charge interest on margin for accounts that choose to trade on margin.

Second, they have a longer-term plan to offer an API for their system and charge for access. This is likely to be the bigger money earning source, but it doesn’t really impact individual investors.”

At the comment part of The College Investor blog, another trader writes:

“Stock research and charting tools on the app are basically non-existent, I do my research on other websites, and have third party charting subscription. I can see how it might be cumbersome trying to manage a large portfolio from the app. Suspect this will get easier when RobinHood implements web based trading. I’m using RobinHood for individual stock trades, other ETFs, and to trade user-defined stock baskets”.

Then he concludes: “In the future, if their web based software incorporates some basic portfolio management/monitoring tools, I will probably move my entire portfolio to Robinhood.”

For the conclusion of RobinHood app, there are several tips that are worth to give it a try.

First, if you are a Millennial, you don’t have much money to start business but you want to learn, you can start with RobinHood. No minimum deposit needed, therefore one could put in as little as $50 to $100 and start trading (CNN).

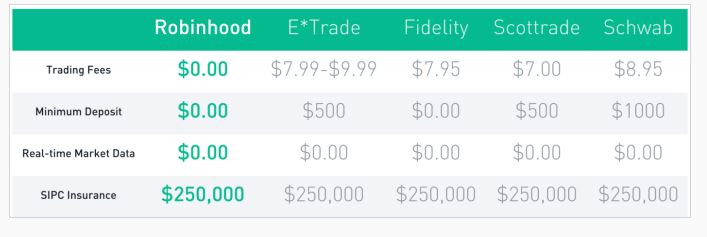

Second, you don’t have to pay any fee; it costs $0 instead of paying $7.99 or more per trade.

Trading fees for each trade

Source: TechCrunch

Finally, even you are an expert or a new user, this app is simple and clear. Certainly it would be a perfect tool to study or experience the stock market. (Robinhood team is working hard to build also an Android app which may comes later this year).

I hope very soon we will see a RobinHood Europe or Switzerland app. Especially in Switzerland the trading commissions are very high, and an app such as RobinHood could disrupt the high commission Swiss market.

Check the Robinhood company video here

[…] Robin Hood Zero Commission Trading; Please come to Switzerland, Finanzprodukt.ch […]